Home > How Much Is Gold Worth Today | Leifs Coins

Gold has been a highly desirable and valuable metal since at least 1500 BC when the first humans began mining it and using it for many different purposes. The value of gold has increased throughout the centuries, mainly due to it being a rare and valuable metal which is easily obtained and transformed into jewelry, coins and other finery.

The value of gold fluctuates greatly, mainly based on the current demand for it and the inability to make new gold through mining. Generally, gold is traded in what are called “spot prices” which measure the gold rate for that day (usually this is established internationally, with various exchanges throughout the world). A spot price will be based on the current demand and supply, and will be subject to daily fluctuations that can be driven by news events, economic developments, or any other type of market movement.

Daily, gold prices will typically be slightly lower in the morning, as traders and investors wake and start to assess the markets, and slightly higher in the afternoon, as investors’ decisions based on news events start to take shape. Prices will also generally decline slightly when the news flow is negative, and increase slightly when the news flow is positive. The prices can also be affected by the overall performance of the US dollars, since higher US dollar values means that people can buy less gold.

The weekly price of gold will generally react to long term extremes in the markets, such as when news of potential political changes, economic downturns, or major deals emerge on the horizon. It is generally a good rule of thumb to buy gold when the markets are in chaos, as people are often more likely to purchase gold as a safe haven asset when they are uncertain of the future.

The yearly valuation of gold is much more difficult to predict, since it is often prone to major swings based on the overall economic situation in the world. Generally, if the economies of the US, Europe, and China (the world’s largest gold markets) remain relatively significant and strong, gold prices will usually remain high. However, if any of these economies experience a major slowdown, gold prices tend to decrease.

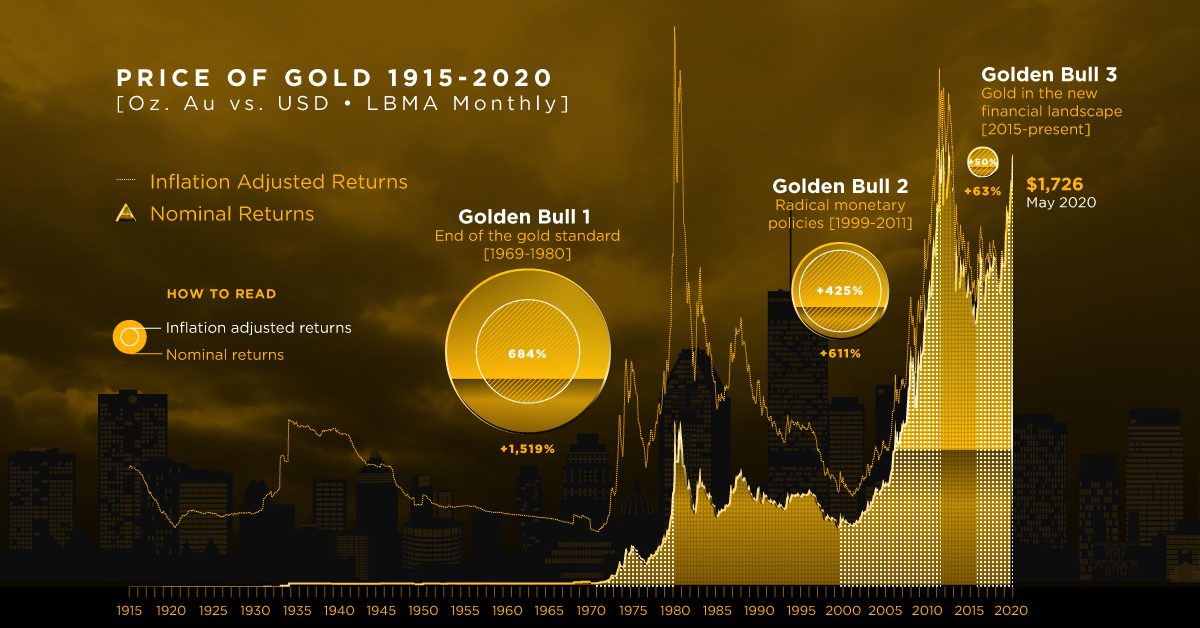

Since its inception of becoming a commodity in 1500 BC, the value of gold has increased significantly in today’s world. This is due to a number of factors, including an increase in gold demand for jewelry and other products around the world, the increasing costs of mining gold, geopolitical instability, and distrust in other financial assets. In the past decade, gold prices have risen astronomically, reaching a new high of around $2000 per ounce in 2020. This price increase is due to a combination of increasing demand, the difficulty of mining gold, and distrust in other financial assets such as stocks, bonds, and the US dollar.

Overall, gold has been and remains one of the most valuable and desired metals on Earth, with its value regularly fluctuating on a daily, weekly, and yearly basis. With gold’s increasing demand, the difficulty of mining gold, and the distrust in other financial markets, gold’s price has skyrocketed in the past decade, and is on track to continue increasing into the future.

Gold buyers, gold dealers, silver buyers, money metal dealers, bullion dealers, and precious metal dealers in Florida and the United States are abundant, but none compare to the quality you receive at Leifs Coins.

Leifs Coin is a great coin shop located in Naples, Florida. Whether you are a beginner or an advanced collector, Leifs Coin is sure to have something for you.

Buy Gold

Sell Silver

3 months ago

Buy Gold

Sell Silver

3 months ago

Buy Gold

Sell Silver

3 months ago

Buy Gold

Sell Silver

3 months ago